We’re Dental Insurance friendly at Ten Mile Dental

Insurance and Billing Made Easy

At Ten Mile Dental, we believe that navigating dental insurance shouldn't be stressful. That’s why we work with most major insurance providers and handle all claims and billing on your behalf.

Our friendly, knowledgeable team is here to make the process as smooth as possible - so you can focus on your oral health, not paperwork.

Contact our team today to learn more about our insurance network participation and how we can help you maximize your dental benefits.

Understand your bill

Understanding your dental bill can sometimes be confusing, and we want to make it as clear as possible. While we strive to provide accurate estimates based on the information available at the time of your visit, your final bill may differ due to factors outside our control - such as changes in your insurance coverage, unmet deductibles, co-pays, or services not fully covered by your plan.

Insurance companies occasionally update their policies or benefits without prior notice, which can also affect your out-of-pocket costs. At Ten Mile Dental, we believe in transparency and are committed to helping you understand your bill.

If you ever have questions or concerns about a charge or balance, our knowledgeable team is always here to help.

Don’t have insurance?

Here’s what costs to expect.

*We include a range because final cost can vary based on the complexity of the treatment your dentist recommends.

Convenient and Secure Payment

As part of our commitment to going green and reducing paperwork, we’ve moved to electronic communications for all balance notifications. Patients can conveniently check their account, view detailed statements, and submit secure payments anytime through their secure Patient Portal.

Access the Patient Portal to:

View your bills in one place

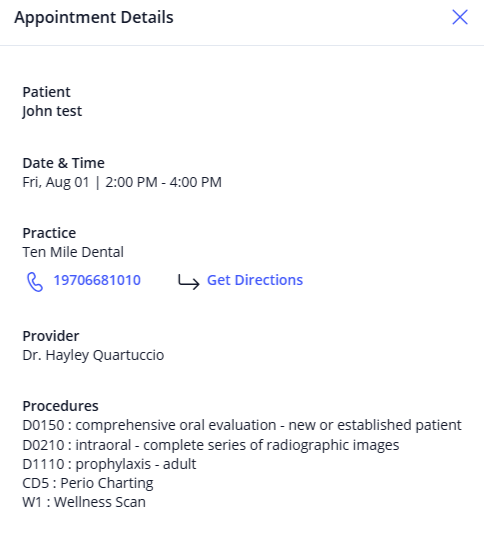

View your upcoming appointments

Manage payment methods

Update medical information

Insurance FAQs

-

We’re in-network with Cigna and Delta Dental Premier. Many patients choose to see us out-of-network and still receive similar - if not the same - coverage levels. Contact our team to learn how we can help you get the most out of your dental benefits.

-

You can always check with your insurance company to find out what they are and how much they cover. However, the Ten Mile Dental insurance team can check for you and give you an exact break down.

-

In many cases, out-of-network benefits cover preventive services at 100%. Exams and cleanings are considered preventive by both Ten Mile Dental and most insurance carriers. Share your insurance details with us, and we’ll help you understand your benefits and provide an estimate of your out-of-pocket costs based on the information your carrier provides.

-

Being out of network simply means Ten Mile Dental does not have a direct contract with your insurance provider - it does not mean we don’t accept your insurance.

Many insurance carriers place limitations on the type and scope of care a provider can offer. At Ten Mile Dental, our providers deliver personalized, high-quality treatment tailored to each patient’s needs, which is why we choose not to participate in certain insurance networks that could compromise that standard of care.When you're out of network, your insurance sets a maximum fee for each procedure and covers a percentage of that amount. If their fee is lower than ours, the difference is the patient's responsibility.

For most, it's a minimal cost difference (if there is a difference at all) to receive the personalized, high-quality care Ten Mile Dental is known for. Patients choose us for our experienced and friendly team, advanced technology, and commitment to comfort and clear communication. -

Dental insurance typically covers a range of services, including preventive care like exams and cleanings (usually twice a year), basic treatments like fillings, and major procedures like crowns, oral surgery, or orthodontics. Coverage is usually grouped into three categories: Preventive, Basic, and Major, each with its own coverage percentage, such as 100% for preventive, 80% for basic, and 50% for major services. Orthodontic benefits are often separate, with specific rules around age, who is eligible on the plan, and a one-time lifetime maximum instead of an annual allowance.

-

Dental insurance is separate from medical insurance, with its own codes, claim process, and in most cases has a yearly maximum benefit. Most medical plans do not cover dental care, and while most medical coverage increases after meeting your out-of-pocket maximum, dental benefits stop once the carrier's annual payment limit is reached.

-

Most dental insurance plans cover two exams and cleanings per year, but every policy is different. Some allow a set number of these visits within a calendar or fiscal year, while others require a specific number of months or days between services. This means coverage may not always be based on a simple yearly count. Contact our team today to learn more about your available benefits.

-

New Patient - $248

Existing Patient - $207

This does not include annual xrays, fluoride treatment, or other preventive services.

We also offer a Membership Plan